The Future Success of Your Mortgage Business Depends on Mastering These 10+ Mortgage Lead Generation Tactics

By Tony Restell

Mortgage leads are the lifeblood of any mortgage broker or loan officer. How fast they flow into your business impacts how fast you can grow. But that’s not all. How cost effectively you can secure those leads also has a significant impact on the profitability of each mortgage deal you are able to close. Given their impact on both the growth and profitability of a mortgage business, we decided to reach out to some high performing mortgage brokers and industry experts to determine which mortgage lead generation tactics you should really be learning to master.

Our thanks to everyone who contributed - and we hope this post will help secure the future success of your mortgage business.

So in no particular order, let’s look at 10+ mortgage lead generation tactics for you to master. Some are standalone tactics. Others reinforce one another. Here’s what you need to know and act upon to succeed:

Getting Leads Through Past Clients

So long as you have provided good service and secured good mortgage rates for clients in the past, your business should have a ready-made pool of people who are primed to do business with you again as and when their next mortgage needs arise, to say nothing of them also recommending you to their friends and family.

To a degree, this means there’s an advantage to all those who’ve been established in the market for the longest period of time. As Tina Shah, Founder of Heritage Financial, remarked: “we’ve been in the market for a long time, everyone knows and trusts us and that’s quite a challenge for a new entrant to overcome”. It helps, of course, that Tina’s business has focused on providing great service and customer experience and therefore maximizes the number of past clients who’d want to look them up again in the future.

For many mortgage businesses that’s only one part of the success equation though. Oliver Orlicki of Orlicki Group has a high touch and highly structured approach to nurturing his past clients. Providing an easy, enjoyable and affordable mortgage experience when securing clients their first mortgage is the foundation for them returning. But Oliver has a process for then keeping in touch with each of these clients on an ongoing basis. Quite intensively for the first 12 months to really solidify the relationship, then on an ongoing basis thereafter so as to be on people’s radar at regular intervals. You never know when a past client might need a new mortgage, so the key is to make sure you’re ever present in their thinking!

Oliver ensures this through an intensive post-close campaign with handwritten note cards, a gifting experience and other services along with a mixture of drip email campaigns that keep conversations flowing with past clients; sporadic email alerts about things of interest to homeowners in his local community; and messages prompting recent new clients to complete online reviews on Google and Zillow, so that their approval for the business is mentally reinforced. This carefully constructed contact strategy, reinforcing people’s positive perceptions of the company, ensures that people remember the business and return to it or recommend it for many years thereafter. So even if you get lots of repeat business, don’t overlook the potential to be winning even more repeat business by improving the end to end customer experience that you provide - before, during and after the close of the mortgage deal.

Getting Leads Through Referrals From Other Businesses

If past clients are the biggest source of mortgage leads - and Christy Soukhamneut of Flagstar Bank believes they are - then the second most important source for many providers will be referrals from other businesses. Christy is Director of Mortgage Strategic Initiatives and stresses the importance of forging strong relationships with realtors, builders, financial planners and divorce attorneys. Each can bring a steady and sizeable flow of primed mortgage leads - and should come to depend on individual mortgage providers who have demonstrated they will deliver for their clients.

So whilst the effort to win these referral relationships may make them a medium term - rather than an overnight - source of new leads, the potential long term value of mortgage business that can be generated by each successful relationship is considerable.

Who you forge these relationships with should also be carefully planned out. There are mediocre realtors and there are top performing realtors. One will bring you a trickle of new business, the other several times as much. So if you’re going to invest time in building relationships with new referrers, make sure you invest that time with the people who can have the most material impact on the mortgage business you’ll close.

Getting Leads Through Clever Use of Data, Alerts and Triggers

David Poules has been a Mortgage Banker at The Federal Savings Bank, Bank of America and Quicken Loans amongst others. He’s seen the impact that clever use of data, alerts and triggers can have on mortgage lead flow. For example, you might set your business up to receive an alert whenever someone runs a credit check as that could be a signal they are thinking of remortgaging. Or you might track the property value of your clients and as it rises by a certain amount that’s a trigger to reach out to them and see if they’d like to increase their mortgage.

Your website and email list can, of course, be great sources of insight about buyer intent too. If you’ve implemented technology such as HubSpot then you’ll be building a list of people whose activities are tracked. If they look at certain pages on your website, you’ll know. If they click on certain links in your emails, you’ll know. Plus these actions can be used as triggers to automatically engage with them. So if someone’s visited a remortgaging page on your website, that might trigger you sending them an email to see if a phone consultation would be helpful. All on autopilot!

All of these approaches are essentially leveraging technology and data to try and get back in front of people who may be thinking of taking out a mortgage or looking at refinancing. Or, more directly, you may look at generating leads by partnering with comparison websites like LendingTree where people are directly signaling their interest in securing a new mortgage. This is not an inexpensive means of securing leads though, with comparison sites’ leads typically ranging from $75 to $400.

Getting Leads Through Social Media Adverts

All of which brings us nicely onto the subject of getting mortgage leads through paid social media advertising campaigns. These can be much more cost effective than buying leads from comparison sites. Firstly, because exclusive leads are far more likely to convert than leads that have been passed to multiple providers; and secondly, because the cost per lead itself is far lower ($60 - $90 per exclusive lead being the norm, at the time of publication).

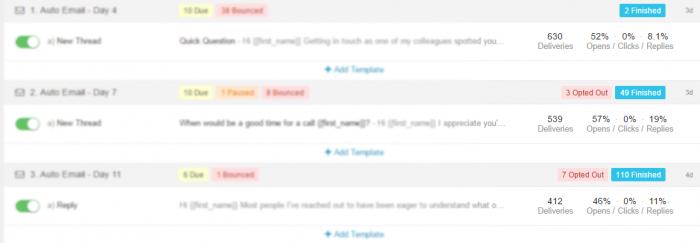

Done well, social media advertising will use data and behavioural targeting to reach an audience of people who are in your location and who are eager to talk to a mortgage broker. It will use offers and copy that are already market-tested and known to be high converters. It will also be backed up by automated follow-up processes that ensure interested leads are immediately contacted and know they can expect your call, since this speed of response is a key success factor in securing new mortgage clients through this channel.

It should come as no surprise that getting all these elements right is most likely to be achieved by working with an agency that has a proven track record in mortgage lead generation campaigns. It’s also important to work with an agency that will generate exclusive leads for you rather than one that sells leads to multiple mortgage brokers simultaneously (be wary of low cost per lead suppliers, this is invariably a warning signal that either their lead quality is poor or that you’re sharing the leads with multiple businesses).

Get this right though and it can be a game-changer for any business wanting to grow in a predictable and controllable fashion, with a consistent acquisition cost for new mortgage wins on a pipeline of leads whose size you control.

(Note: if that sounds like you, do book in for a mortgage broker lead generation call)

Getting Leads Through Social Media Credibility and Online Reviews

Where social media advertising generates a known number of mortgage leads for a given budget, broader social media and online presence is harder to quantify. But its importance is something Christy Soukhamneut is passionate about - and indeed we should probably make the distinction here between two different activities.

First up are online review sites. Christy stressed to me how potential mortgage clients will often Google search the names of loan officers and find LinkedIn, Zillow or Facebook reviews about them. They might also search for companies and discover their Google reviews or Zillow reviews. All have the potential to influence whether someone proceeds with a mortgage application and / or contacts that business or loan officer / mortgage broker in the first place. So encouraging your team to proactively secure online reviews will aid both your lead generation efforts and your lead conversion rates.

Alongside this is the broader question of social media presence and credibility. A company with a presence across social media is likely to be found by more potential mortgage customers. Did you know, for example, that on Facebook you can search for “Mortgage Brokers in New York” and that’ll bring up the details of the mortgage brokers who have an established presence on Facebook? So if you aren’t there, you are automatically missing out on leads that might otherwise have come your way.

Social media pages also tend to rank highly in google search results, so having them established can be a great way of appearing in more Google searches (and of course it’s essential that you have your Google My Business page setup to appear prominently in local google search results with your location, opening hours, star rating and the like all displayed). But all should be viewed as medium term tactics rather than actions that will bring an immediate flurry of new leads.

Getting Leads Through Search Engine Advertising

Paying to advertise on search engines such as Google or Bing is something of a double-edged sword. A huge positive of the search engine advertising lead generation approach is that people are searching for specific mortgage related queries when your advert appears in front of them. The potential to get in front of people who want to choose a mortgage supplier is, therefore, very high indeed.

The flip side of this is that big lenders have invested huge sums of money in setting up and testing every element of this mortgage lead generation process. They have developed huge numbers of landing pages that have each been optimized to work well for a specific search query. They have done the A/B testing to extract every last bit of conversion value from each visitor to these pages.

Not just that - as Christy Soukhamneut confirmed to us, for any type of pay-per-click or pay-per-lead campaign it’s essential to have a slick follow-up process in place. Once someone expresses an interest, it’s key that they then quickly receive email, SMS, voicemail or call center follow-up so that they are solidified on the idea of speaking with you rather than going in search of another provider.

Because the major lenders have perfected all these elements, they are able to extract the maximum value from the search engine advertising leads they buy. This consequently means they are able to pay top dollar for those leads - and because Google and Bing are bidding platforms, pay per click rates tend to be bid up to the level that the most successful businesses can sustain (in the screenshot below, you can see a $19 pay per click rate is expected for the search term “mortgage” and if we assume that <10% of people visiting a page are going to actually submit an enquiry then your cost per registered lead is likely to be $200+ and that’s before those leads have been qualified).

So, just as with getting leads through social media advertising, there is a steep learning curve and the potential to lose a lot of money if you go down the do it yourself route. For small and medium sized brokers, you’re best off engaging a specialist agency if you want to try this approach. We’re not a search engine advertising agency, so can’t help you directly with this. But just as with social media advertising, there are agencies that specialise in the market and you really want to be working with one that already knows exactly how to get these results to accelerate the timescales in which you’ll get a positive return on your spend.

Getting Leads Through Organic Search Engine Optimization

When it comes to getting natural (organic) search engine traffic from sources like Google and Bing, the key thing to know is that it’s a long term investment to try and increase this lead source - with no guarantees of ultimate success.

Getting a page 1 ranking on Google is firstly something that’s the preserve of the most established businesses in the industry; and secondly these results can change significantly over time, meaning it’s dangerous for your business to become over-reliant on them as a lead source in any case.

If we use Neil Patel’s Ubersuggest tool we can get a quick snapshot of the challenges that face a mortgage broker business in trying to get highly ranked on Google search result pages. If we look at data for searches for “mortgage” as an example, we can see a high SEO difficulty score and also that the average page listed in the top 10 search results has 899 other websites that link to it and a domain score of 86 (which is very high, these domain authority scores range from 1 to 100 and the higher your score, the better your website will rank - but you have to be a major established national or global brand to achieve these kinds of scores).

It’s true that a search engine optimization (SEO) agency could draw up a long list of search terms that have much lower search volumes and aren’t as highly contested as the search term “mortgage” (with these less popular search terms known as “long tail” search phrases). Creating pages for each of these search terms is costly though and even then the competition and your chances of success are stacked against you.

In short, this is a lead generation strategy that should be embarked upon only if you have deep pockets and if you have a medium to long term time horizon for potentially getting results. The agencies we spoke to who work on SEO advised that a time window of 12 months+ is needed to generate results - and there may be the requirement for significant work to be undertaken on your website in order to implement their recommendations for getting your website ranking more highly.

Getting Leads Through Remarketing

Now for something much more upbeat - an idea that pretty much any bank or mortgage broker could implement. Have you ever been online, browsing to book a vacation or buy a new TV - and then in the weeks that follow, you notice adverts for these things keep following you around the internet? Well this is what’s known in the marketing industry as remarketing.

Put simply, you create highly targeted adverts for people who have visited specific pages on your website (or key landing pages) before. By creating a remarketing campaign, you are allocating part of your marketing budget to be invested only in those who have already shown some level of interest in one of your offers.

Let’s say through various marketing efforts you’ve had lots of people visit a “First Time Buyer” mortgage enquiry page. Now let’s say that your website has historically converted X% of those visitors to actually submit an enquiry. But that’s the percentage of people who converted on that one time of being prompted to do so. What if they weren’t ready to take that step? What if they visited that page from their smartphone but baulked at the idea of filling in your form whilst on their phone? Ordinarily you’d have lost those leads and there’d be only the minutest chance of them returning to your website and completing that step at a later date.

Well now let’s imagine that in the following weeks you’re able to have adverts follow them around the internet and encourage them to return to your website to complete that next step. The wording of that remarketing advertisement can be hyper targeted, because you know what they were interested in when they visited your website and so you write a retargeting advert worded precisely to address that desire or need.

It’s not hard to imagine that your overall conversions would ratchet up considerably, right?! Well that’s remarketing - it’s conceptually really simple to understand and can be implemented through Facebook, Google, LinkedIn and the like with a relatively modest budget. If you’re working with a social media agency to generate ads through social media advertising, the chances are they’ll already be doing this for you as part of their service.

Getting Leads Through An Email Newsletter

Last but not least are email newsletters. We saw earlier how a well structured email “drip campaign” can help you stay in touch with past clients and / or prospects, by having them receive a sequence of emails over time (with that sending triggered by them either having become a mortgage client or having submitted an initial enquiry on your website).

A variant on this is to send a regular email newsletter that helps you to stay in front of past clients and / or prospects. This typically works best for brokers who serve a niche market, because then your business is well suited to offering a newsletter that brings people insights about eg. what’s happening in the real estate market in your local area or the latest developments in the waterfront residential market or home buying news for teachers.

If you serve a readily identifiable group of people with common interests, then this is a lead generation channel that your business may be well suited to exploit. By sending out a regular newsletter (at least monthly and ideally every 1-2 weeks) then you are ensuring that you are regularly on the radar of your readers and so are well positioned to be their first port of call when the time comes that they next want to remortgage or make a new mortgage application.

Just as with search engine optimization, this is essentially a medium to long-term play though. Firstly, because it will take some time for you to build up an email list of people who want to receive your newsletter (and that’s critical, sending newsletters to people who didn’t request them just alienates people and so is counter-productive). In addition, though, even once we have grown a sizeable list of recipients, only a tiny fraction of them are going to be interested in getting a mortgage each month and so you might have to send a newsletter for several years to have reached everyone on your list at a point in time when they were actually considering who their next mortgage should be secured through. Keep that in mind when you’re deciding what to invest in and how quickly you need to generate results.

Stop! How Will You Fulfil Your Lead Targets For This Coming Quarter?

So we’ve covered a lot of ground in this comprehensive post, with 10+ mortgage lead generation ideas that are potentially highly relevant for your business. Some are things you can implement or influence yourself. Others need external support to get off the ground. Some will bring you almost immediate results. Others are more of a medium to long term play.

If you’re looking at your pipeline for the coming quarter and thinking you’d like to drive more new mortgage business, the question is then which of these ideas can you realistically turn on and have them producing results for you in that kind of timescale?

One such option is certainly partnering with an agency to generate guaranteed lead volumes through social media adverts. If you’d like to have a quick exploratory chat with our team about this and establish what lead volumes we could guarantee then do book in for a mortgage leads call today.

Thanks for reading, thanks again to all our expert contributors for their insights - and wish you every success in securing more mortgage leads for your business.

The kind of stuff that Social Hire do...

We won't just do social media strategies. Social Hire will work collaboratively with your team to ensure your business gets genuine value from us and that your team gets the most out of the service. Our experienced social media managers are motivated to make a enhancements to your social media marketing and reaching targets in a way that realistically makes a difference to your business goals.

Isn't it time to stop making difficult personnel choices that don't work well for your online marketing?

The social media marketers in our company are the best in the business at helping our partners enhance their online marketing. We outline and implement cutting-edge social media marketing plans that help our customers realise their organisational objectives and further their social media presence. Our experienced team of digital experts do your social media strategy creation and management in an uncomplicated monthly plan that is cost-effective and is genuinely useful, whatever results you demand from your marketing team.

Our specialists are a company that assists our customers further their presence online by giving online marketing on a regular basis.

You might like these blog posts How Modern Businesses are using Social Media and Artificial Intelligence, How to Use Social Media to Engage With Your Clients, 4 PEO Stats That May Surprise You (And Help Your Company), and What You Can Expect in Revolutionary 2019 HR Technology.